ACA Overload? We can help!

Are you feeling overwhelmed by the complexities of the Affordable Care Act? First of all, you are not alone!

If you need software for management & reporting, look no further than the ACA Management Tool®.

With the ACA Management Tool® on your side, you don’t have to feel overwhelmed anymore.

WHO?

ACA Management Tool® is an industry leading software solution. It easily integrates with any payroll, scheduling, or HR system. After a few simple uploads, you can quickly and easily determine Applicable Large Employer Status. You’ll also know which employees qualify for coverage. You can then make offers and document responses, and generate the necessary IRS forms for reporting.

WHAT?

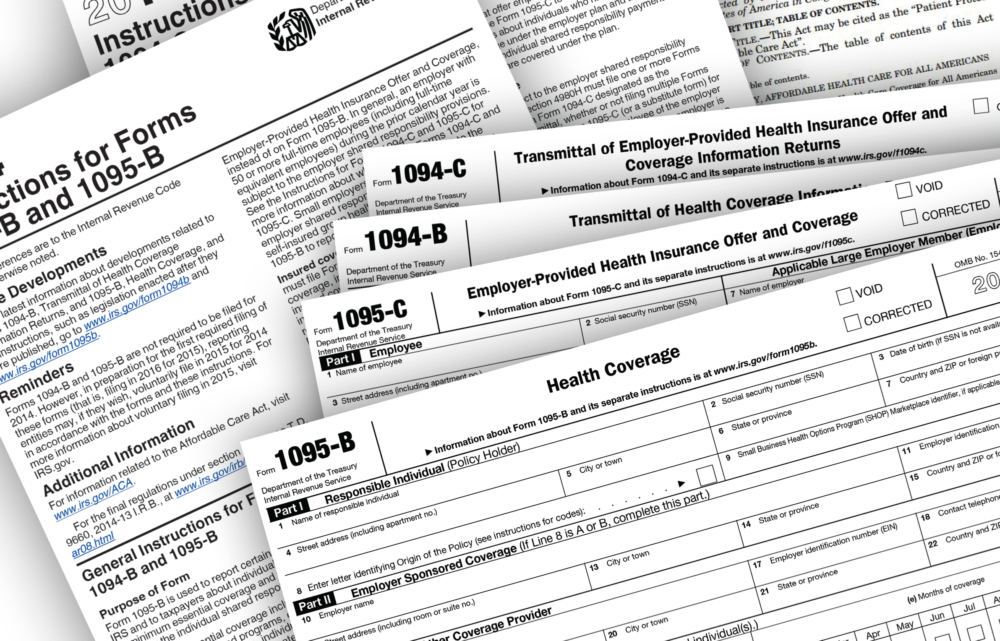

New regulation means new IRS forms

In 2014, the IRS and Treasury issued final regulations on the Employer Shared Responsibility provisions under section 4980H of the Internal Revenue Code. Under IRC §6055 and §6056, new forms must be filed with the IRS. These forms are the 1094/1095B and 1094/1095C.

WHEN?

NOW is the time

If you have 50 or more Full Time Employees (or Full Time Equivalents) you need to be ready to report to the IRS. You should be tracking the information needed for those reports NOW. The deadlines for Tax Year 2021 reporting are:

- Form 1095 postmarked to employee or responsible individual: March 3, 2025

- IRS e-filing Form 1094/1095 deadline: March 31, 2025

WHY?

Your options are “Pay” or “Play”

Under the Employer Shared Responsibility provisions, if employers do not offer affordable health coverage that provides a minimum level of coverage to their full-time employees (and their dependents), the employer may be subject to an Employer Shared Responsibility payment if at least one of its full-time employees receives a premium tax credit for purchasing individual coverage on one of the new Affordable Insurance Exchanges, also called a Health Insurance Marketplace.

HOW?

Contact Us

Visit www.acagps.com to learn more.

Email info@acagps.com to receive more information.

Don’t let ACA reporting overwhelm you any longer!

ACA GPS has developed the ACA Management Tool® to assist employers (Large and Small) with achieving compliance with the ACA. We are authorized to transmit 1094/1095 B and 1094/1095C series forms for private businesses, government entities, and insurance companies.