Discover DECATool®

Software to securely conduct Dependent Eligibility Audits

Demonstrate Fiduciary Responsibility,

Protect Plan Resources and Save Money.

Why should you conduct a Dependent Eligibility Audit?

- Between 2 & 10% of dependents are determined to be ineligible after an audit

- Annual claims payout for a dependent averages $4,700

- Self-funded plans face a unique set of challenges, including scrutiny from ERISA and SOX

Using DECATool to conduct a Dependent Eligibility Audit is affordable, professional, and easy to do.

The communications sent to plan participants are professional, respectful, and directly reflect the tone of the company.

The dependent eligibility audit can be customized to meet your goals & objectives, according to your timeline.

The plan can realize significant savings through reduced premiums and lower administrative costs.

DECATool provides the oversight and documentation you need to show that you are in compliance. Use DECATool to maintain plan integrity and avoid potential ERISA penalties.

DECATool makes Dependent Eligibility Audits professional, affordable, and easy.

Sign up for a dependent eligibility audit through DECATool and be confident that the audit will be professional and secure.

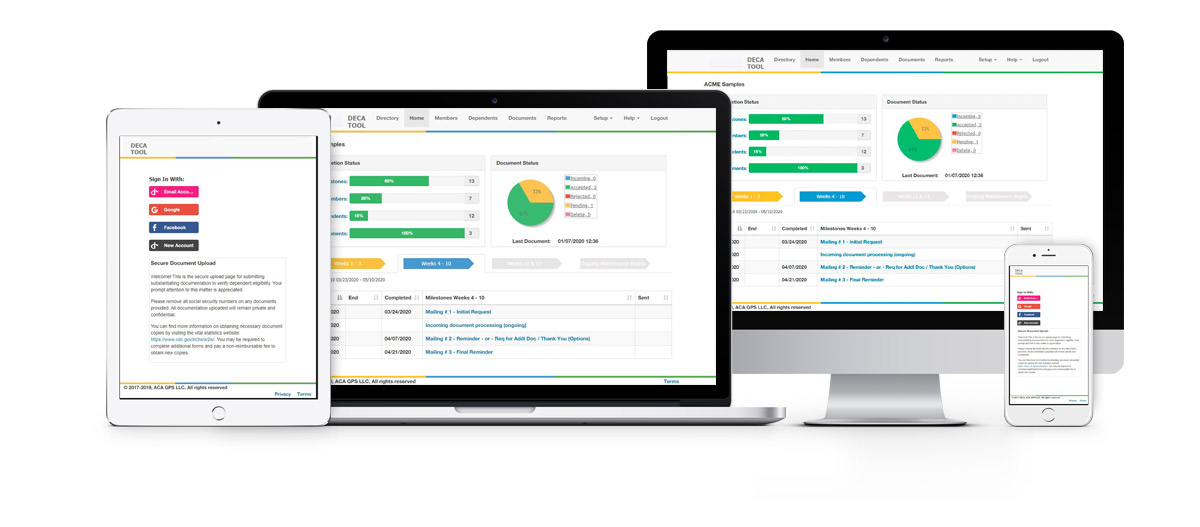

Cloud based, secure, easy to use software. SOC 2, Type II certified.

Professional, respectful communications.

Reasons for ineligibility are not necessarily attempt to deceive.

Plus:

- Employee portal is secure and easy to use.

- Documents can be uploaded via computer, tablet, or mobile devices.

- Document storage is secure and confidential.

- Personally Identifiable Information (PII) is kept secure and confidential.

Why audit using DECATool?

You Don’t Have Time.

We work with you to develop a project timeline that meets your overall goals and objectives. Then we get to work.

Your Data is Precious.

We understand and we do everything to keep it secure. ACA GPS is SOC 2 certified, as well as NIST AZ Ramp Compliant.

You Don’t Have Enough Resources.

Let us conduct the audit for you. We’ll handle all of the outbound communications, review the incoming documents, and provide a final analysis report.

Your Money is Valuable.

The whole reason for conducting a dependent audit is to conserve plan resources and reduce overall plan costs. We made DECATool affordable so that the plan can realize those savings after the audit.

Stop wasting money covering ineligible dependents.

DECATool will easily and efficiently audit your plan participants.

A dependent eligibility audit with DECATool will save the plan money by identifying ineligible dependents, allowing the plan sponsor to remove them from coverage and reducing the potential for ERISA penalties.

You’re just 3 steps away from saving money:

View a Demo & Get Answers

Spend 30 minutes to view a live demo and see how the audit will be conducted. Ask questions and get answers.

Sign Up & Get Set Up

Meet your Lead Auditor and establish a project timeline. Provide your group health plan census and plan documents.

Sit Back & Relax

The professionals at ACA GPS will conduct the dependent eligibility audit and you’ll receive a final report at the end of the project.

See How Much You Could Save

Download our case study to see how one self-insured employer saved tens of thousands of dollars by conducting a Dependent Eligibility Audit using DECATool.