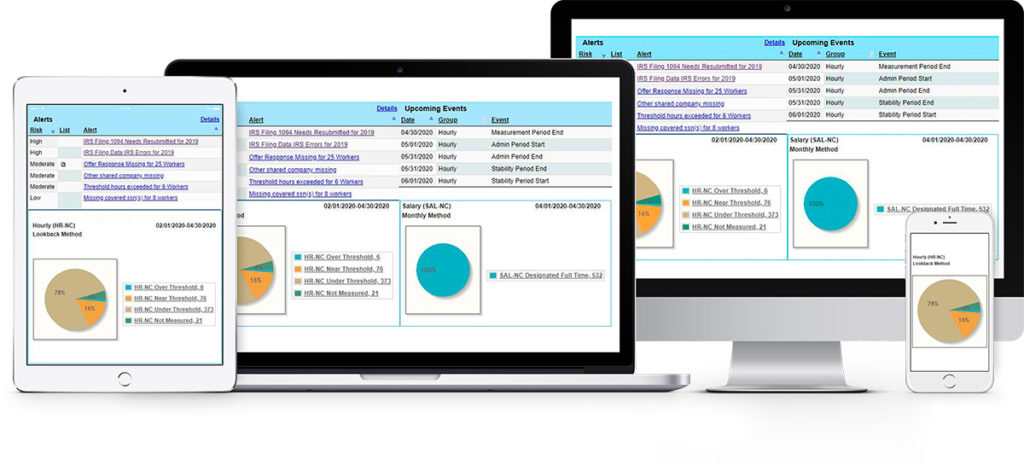

Discover ACA Management Tool®

Software to create and e-file 1094/1095 ACA reports with ease

ACA compliance is hard. We get that.

Create, distribute, and e-file ACA forms in less time, for less money, with fewer headaches.

Are you wasting time and money using ACA software that isn’t working for you?

Do you or your staff:

- Feel overwhelmed when trying to comply with the ACA?

- Feel like your ACA vendor doesn’t provide the support you need?

- Feel like you aren’t sure what your reporting responsibilities are?

The right ACA software can solve your problems while saving you time and money.

ACA compliance is hard, but with the right partner and software, it doesn’t have to be impossible.

We break the process down into manageable pieces so that you won’t waste time trying to understand the entire ACA regulation. We have Certified Healthcare Reform Specialists® on staff to help you.

The ACA is hard, but reporting doesn’t have to be.

ACA Management Tool can help you achieve ACA compliance quickly and easily.

We understand the ACA so you don’t have to.

Use ACA Management Tool and you can be confident that your ACA reporting will be done right the first time.

Breathe easy knowing that the ACA software you are using will help you achieve compliance.

Relax because you have a dedicated team of experts ready to help when you need them most. Plus:

- Coding analysis is available at the aggregate level

- Data is analyzed prior to distribution / IRS submission

- Issues that may incur penalties are highlighted

- Deadline reminders are provided throughout the filing season

Why choose ACA Management Tool®?

Your Time is Limited.

We work with you to quickly organize your data, upload it for processing, and show you efficient ways to review the information prior to distributing and e-filing.

Your Data is Precious.

We will keep it secure. ACA GPS is SOC 2, Type 2, certified. We are also NIST AZ Ramp Compliant.

Your Resources are Scarce.

You’ll have a dedicated agent guiding you through the complexities of the ACA. The ACA is hard. We know your pain. We also know the ACA. You won’t be alone. Let us help you.

Your Money is Valuable.

ACA Management Tool is affordable. Subscriptions are based on the number of forms that need to be filed. For an additional fee, we can mail them to employees for you.

Don’t struggle through another ACA reporting season.

ACA Management Tool® will save you time and money.

You’re just 3 steps away from an easy ACA reporting season:

Schedule a Demo

& Get Answers

Spend 30 minutes now to save hours later. Learn how easy ACA Management Tool® makes Affordable Care Act compliance.

Sign Up &

Meet Your Team

Select the subscription option that best suits your needs. Meet your dedicated Customer Support Representative.

Report & Relax

ACA Management Tool® sets you up for reporting success. You’ll meet all deadlines with time to spare and you can relax knowing it was done right.

Unlimited Users

Monthly Uploads

Unlimited Users

Unlimited Uploads