Tax Year 2021

1095 Distribution Deadline

March 2, 2022

Affordable Care Act Form 1095 : postmark by March 2, 2022

Looking for software to create and e-file Forms 1094/1095B or 1094/1095C? Get It Here!

Want to receive more information? Call 470-400-0777

Or complete a Contact Us form

The links below are for Tax Year 2021.

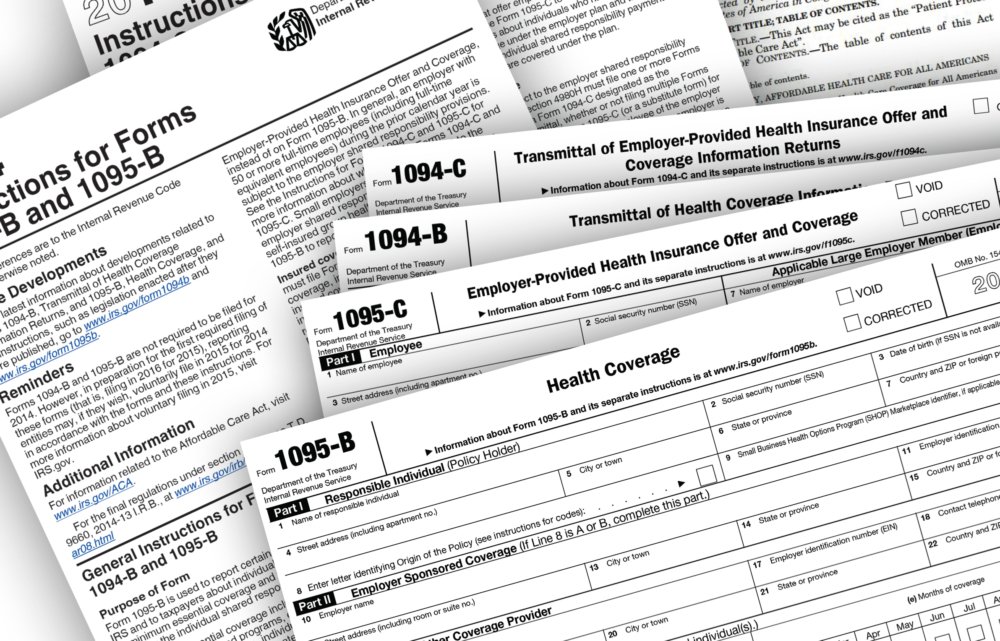

Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year 2021

Form 1095B – Health Coverage – Tax Year 2021

2021 Instructions for Forms 1094-B and 1095-B

Form 1094C – Transmittal of Employer-Provided Health Insurance Offer & Coverage Information Returns – Tax Year 2021

Form 1095C – Employer-Provided Health Insurance Offer and Coverage – Tax Year 2021

2021 Instructions for Forms 1094-C and 1095-C

Q: Can you mail the 1095 forms to my employees?

A: Yes. ACA GPS offers a Print, Pack & Mail package. Contact sales@acagps.com for pricing and deadlines.

Q: Can you transmit to the IRS?

A: Yes. ACA GPS has obtained a TCC (Transmitter Control Code) from the Internal Revenue Service’s (IRS) Affordable Care Act Information Returns (AIR) Program as both a transmitter and a developer. As a subscriber to the ACA Management Tool® employers transmit the data required under IRS §6055 and §6056 directly from within their subscription using our TCC number. All transmissions are time/date stamped and are available to the subscriber to use as evidence in the event of an audit.

Q: Can I purchase a subscription online?

A: Yes. Our Reporting Only Subscription product is available for purchase online. You can get started in just a few easy steps. C Series and B Series subscriptions are available. We accept Visa, MasterCard, and American Express.

If you are interested in learning more about our Full Subscription product, please complete a Contact Us form or call us at 470-400-0777.