Product Feature: Analysis

Applicable Large Employer Status

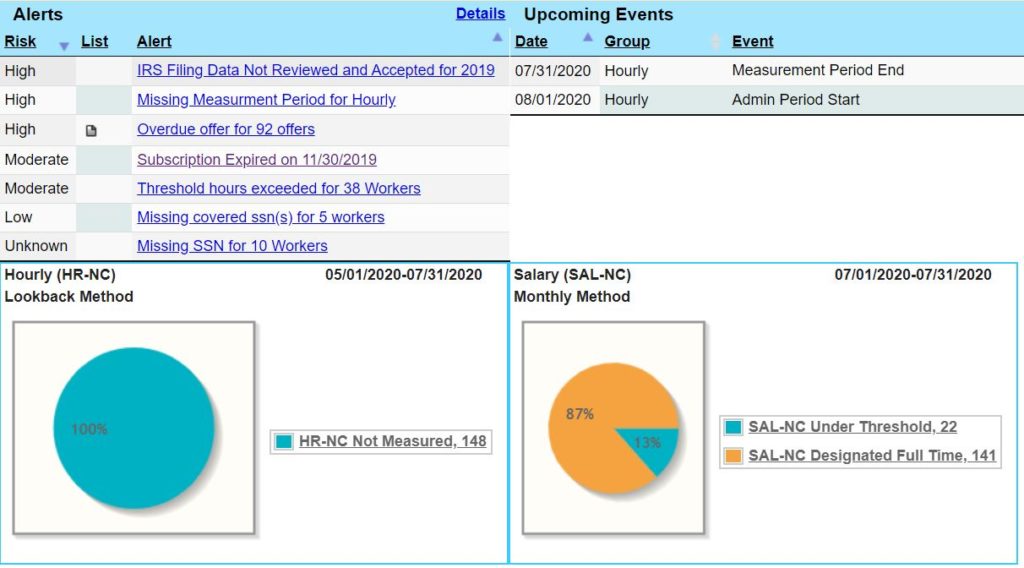

Dashboard Alerts

- Applicable Large Employer (ALE) status

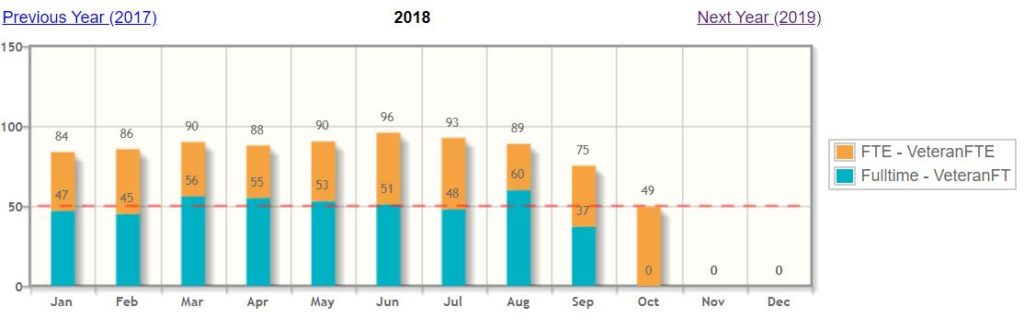

- Full-time employees and Full-time equivalents

- Variable and Seasonal employee hours to determine Full-time status

- Exposure to premium payments and assessable payment liabilities

- Affordability of Minimum Essential Coverage (MEC)

- Look-back Measurement Method

- Monthly Measurement Method/Real-Time (Monthly Analysis)

Q: Does your solution allow an employer to compare scenarios, assess the risk of penalties, and drill into details of specific employees that present possible fine risks?

A: Yes. ACA Management Tool® provides employers with an overview and detailed analysis of their compliance status in regards to the Affordable Care Act regulation, including both Section 4980H(a) and Section 4980H(b) penalties. The user has the ability to compare scenarios for different categories of workers using both the Lookback and Monthly Measurement Methods. Employers can analyze data at the Company level, or any subdivision (department, location, region, etc) within the company. Additionally, an employer can drill down to the individual employee level for a detailed current and historical status report from multiple areas within the application.

Q: Can your solution handle both measurement methods outlined in the Affordable Care Act regulation?

A: Yes. ACA Management Tool® allows an employer to track employees using either the Lookback Measurement Method or the Monthly Measurement Method. The system documents all status changes at the employee level, creating an audit trail. The employer dashboard provides insight into employees that are near the threshold, at the threshold, or over the threshold of eligibility. The dashboard also alerts the employer to any upcoming events that are on the 30-day horizon (i.e. Measurement Period Ending, Administrative Period Beginning, IRS filing deadlines, etc.)