Product Feature: Knowledge

- Affordable Care Act knowledge to make better business decisions

- Gain insight into company operating resources

- Understand the Affordable Care Act (ACA)

- Understand company compliance status as defined by the IRS

- Have questions answered by a Certified Healthcare Reform Specialist®

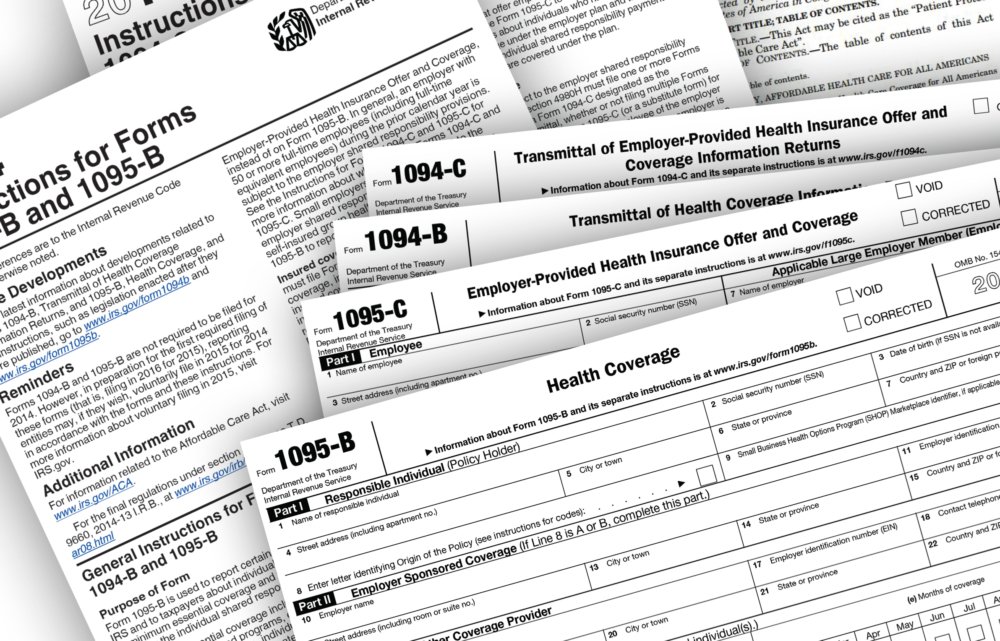

Section 6055 and Section 6056 IRS Forms:

1094/1095 B’s and C’s

Download Documents

- Form 1094B

- Form 1095B

- Instructions for Forms 1094B and 1095B

- Form 1094C

- Form 1095C

- Instructions for Forms 1094C and 1095C

The ABC’s of Forms 1095A, 1095B, and 1095C: American taxpayers need to know the ABC’s of the Affordable Care Act coverage reporting forms that they will be receiving from the marketplace, their insurance company, and/or their employer. Click here to review an article we wrote explaining the forms.

Expertise

The designation of Certified Healthcare Reform Specialist® (CHRS®) represents a superior level of healthcare reform knowledge. Specialists possess the training and knowledge to implement and manage healthcare reform regulations, have access to expert employee benefits attorneys, and are able to help employer clients with their healthcare reform strategy.

To earn a CHRS® designation, specialists must study:

To earn a CHRS® designation, specialists must study:

- Impact of ACA Mandates on Employer-Sponsored Group Health Plans

- Essential Health Benefits vs. Minimum Essential Coverage – How they differ & why it matters

- Strategically Communicating with Employees about Healthcare Reform

- Public and Private Insurance Exchanges – What they mean to Employers and Employees

- The Who, What, Where, and When of the Employer Mandate Under ACA

- Fiduciary Fundamentals for Group Health Plans

- ACA Practical Considerations & Litigation Avoidance

Subscribers to the ACA Management Tool® have access to Certified Healthcare Reform Specialists® at ACA GPS.

Q: What is the Patient Protection and Affordable Care Act?

A: The Patient Protection and Affordable Care Act (PPACA) is a United States federal statute signed into law on March 23, 2010. It represents the most significant regulatory overhaul of the United States health care system since Medicare and Medicaid were passed in 1965. The PPACA was enacted to increase the quality and affordability of health insurance, lower the uninsured rate by expanding private and public insurance coverage, and reduce costs of health care for individuals and the government. It consists of a combination of measures to accomplish these goals including Individual Mandates and Employer Mandates.

Q: What are the 1095-A, 1095-B & 1095-C forms and what is the difference?

A: These are the Affordable Care Act coverage reporting forms. The 1095-A will be sent to anyone that purchased health insurance through healthcare.gov. The 1095-B will be sent to anyone who purchased health insurance directly from an insurer, or if they received coverage through their small business employer (not subject to the employer mandate). The 1095-C will be sent to anyone that was offered or received health coverage from an Applicable Large Employer (subject to the Employer Shared Responsibility Provision).

Q: How are the ACA forms similar?

A: The ACA forms provide information about your health coverage during the previous year. Although you may receive more than one form, and they may come from different sources, they should all be kept with your tax records.