Section A and Section B Penalties

Under the Affordable Care Act there are two types of penalties that an Applicable Large Employer (ALE) may be assessed. Read on for important details regarding these penalties that employers need to understand before filing their 1094/1095C Forms with the IRS.

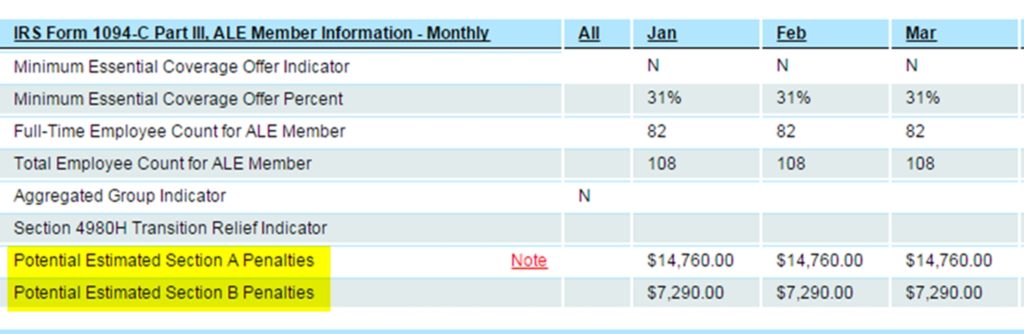

Section 4980H(a), 95% Rule

Assessed on Each ALE Member (EIN) Individually

- Employer did not provide an Offer of MEC to more than 5% of its eligible employees, or 5 eligible employees, whichever is greater.

- All or Nothing: If you fail the test you pay penalties on everyone that was eligible, even if you made an offer, and even if they accepted.

- Triggers when one eligible employee purchases MEC from a Public Exchange and receives a subsidy.

- Penalty: $2320 per person x 1/12 per month ($193.33/month) for the Tax Year 2018. Minus the first 30 employees per ALE (prorated if additional ALE Members exist).

Section 4980H(b), Minimum Value and Affordability

- Employer offered MEC that did not meet MV or Affordability standards.

- Assessed on a one-to-one basis.

- Penalty: $3480 per person x 1/12 per month ($290/month) for Tax Year 2018.

- The total cannot exceed the Section(a) penalty amount.

- Only triggered if an eligible employee purchased MEC from a Public Exchange and received a subsidy.

Failure to File Information Returns

$270 per 1095 not filed with the IRS*

$270 per 1095 not distributed to employee and/or responsible individual*

*Penalties are capped at $3,285,500 per calendar year and per infraction type, $6,565,000 combined.

Please Note: This information is provided as educational information only and is not intended to be construed as legal advice. Employers with questions specific to their situation should contact legal counsel for advisement with regard to the Patient Protection and Affordable Care Act (PPACA).

Do you know what you might owe? Would you rather be compliant?

Visit www.acagps.com to learn more.

Email info@acagps.com to receive more information.

Avoid Penalties: Contact us & achieve compliance on ACA Reporting!

ACA GPS has developed the ACA Management Tool® to assist employers (Large and Small) with achieving compliance with the ACA. We are authorized to transmit 1094/1095 B and C series forms for private businesses, government entities, and insurance companies.