Tax Year 2021

IRS Filing Deadline (e-File)

March 31 2022

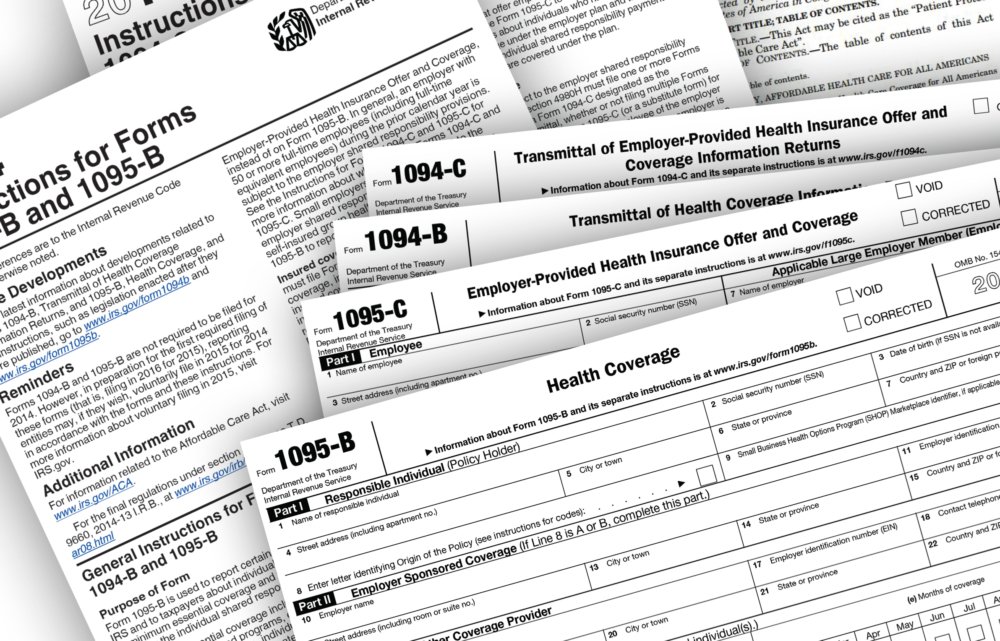

Affordable Care Act forms 1094/1095B and 1094/1095C

The links below are for Tax Year 2021 forms.

Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year 2021

Form 1095B – Health Coverage – Tax Year 2021

2021 Instructions for Forms 1094-B and 1095-B

Form 1094C – Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns – Tax Year 2021

Form 1095C – Employer-Provided Health Insurance Offer and Coverage – Tax Year 2021

2021 Instructions for Forms 1094-C and 1095-C

Will you be ready to report? These deadlines will be here before you know it. What is your Affordable Care Act reporting solution going to be? Click here to see how the ACA Management Tool® will help you be READY TO REPORT!

Need software to create and e-file Forms 1095-B & 1095-C?

Get It Here! Want more information? Call 470-400-0777 or use a Request Form

Q: Does the ACA Management Tool® submit the forms directly to the IRS on behalf of the employer?

A: Yes. Subscribers to the ACA Management Tool® electronically file their 1094/1095 C (or B) forms to the IRS via ACA GPS’s TCC number. Employers do NOT need to apply for their own TCC number with the IRS. There is no need for the subscriber to conduct IRS testing or attempt to create an XML file.

Q: Where can I find instructions on electronically filing the forms to the IRS?

A: Instructions for electronically filing the forms to the IRS are available through these links: 2021 Instructions for Forms 1094-C and 1095-C or 2021 Instructions for Forms 1094-B and 1095-B. However, if you decide to subscribe to the ACA Management Tool, you do NOT need to apply for a TCC number with the IRS. There is no need for you to conduct IRS testing or attempt to create an XML file. ACA GPS is authorized to transmit all 1094/1095 B and C submissions to the IRS for private businesses, government entities, and insurance companies. For all previous Tax Years, 100% of ACA Management Tool® subscribers met the deadlines for distribution of the 1095 forms and electronic filing of the 1094/1095 forms with the IRS. Additionally, those subscribers that received “TIN/SSN Validation Error” messages were able to correct and resubmit to the IRS in a timely manner, at no additional cost to the employer.

- No TCC needed

- No IRS testing needed

- No XML file needed

- Guaranteed submission to the IRS

- One Tool® does it all – the ACA Management Tool®