Tax Year 2020

IRS Filing Deadline (Mailing)

March 1 2021

ACA Reporting Deadline (Mailing)

If an employer is filing by mail, the 1094/1095B or 1094/1095C forms must be postmarked to the Internal Revenue Service by Monday, March 1, 2021.

The links below are for Tax Year 2020 forms.

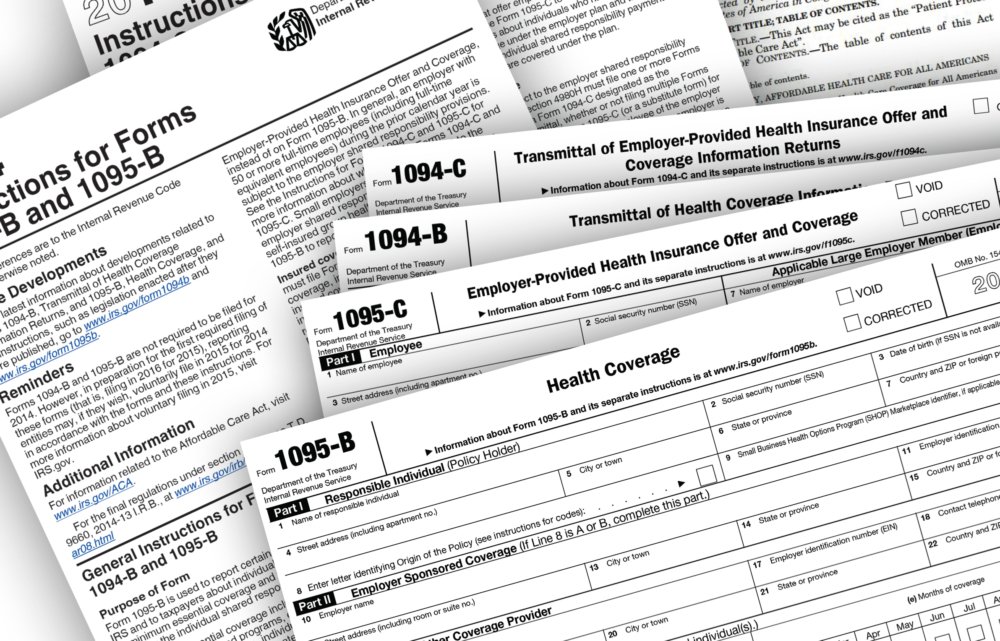

Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year 2020

Form 1095B – Health Coverage – Tax Year 2020

2020 Instructions for Forms 1094-B and 1095-B

Form 1094C – Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns – Tax Year 2020

Form 1095C – Employer-Provided Health Insurance Offer and Coverage – Tax Year 2020

2020 Instructions for Forms 1094-C and 1095-C

Q: What are the 1095-A, 1095-B and 1095-C forms and what is the difference?

A: These are the Affordable Care Act coverage reporting forms.

If you purchased health insurance through healthcare.gov, you will receive a 1095-A. The A form will contain information about the coverage, who was covered, and when.

If you purchased health insurance directly from an insurer, or if you received coverage through your small business employer (not subject to the employer mandate), you will receive a 1095-B. The B form also contains information about who was covered and when.

If you were offered or received health coverage from an Applicable Large Employer (subject to the Employer Shared Responsibility Provision), you will receive a 1095-C. The C form contains information about the type of coverage that was offered. If the ALE offered coverage that was “self-insured”, information about who was covered and when will be included on the C form as well.

Q: How are the ACA forms similar?

A: These forms provide information about your health coverage during the previous year. Although you may receive more than one form (possibly from different sources), they should all be kept with your tax records.

Q: Where can I find instructions on mailing the forms to the IRS?

A: Instructions for shipping & mailing the forms to the IRS are available through these links: 2020 Instructions for Forms 1094-C and 1095-C or 2020 Instructions for Forms 1094-B and 1095-B